The Essential Solution is a strategy that is compiled of a one of a MEC plan, composite rated indemnity plans, and major medical plans. We help protect instead of penalize businesses. That means protect businesses and their employees families by providing insurance plans at an affordable rate while ensuring compliance with the ACA. We also include telemedicine coverage, a discount RX card, accident and critical illness coverage. We offer a simple census enrollment process and also have the industry's top technology available as a complimentary service so you can help more clients.

Minimum Essential Coverage (MEC)

The Affordable Care Act states that all individuals must have health benefits and all employers with 50 or more full-time employees must provide coverage to all eligible employees or they are subject to fines/penalties. This can be known as "pay or play" or employer shared responsibility. We offer Minimum Essential Coverage plans which both of these penalties are satisfied for the employee and the employer. Our plans are substantially less expensive than traditional medical insurance and serve as a low cost solution for most Companies.

Medical First Dollar Coverage

Group medical bridge insurance with $1,000 hospital confinement benefit provides in insurance coverage for everyday doctor visits and hospitalization. In addition, this program provides lump sum hospital confinement benefits payable directly to employees to help cover medical and/ or non-medical costs associated with a hospitalization.

Supplemental Health

Employers are looking for solutions to help offset the increases in health insurance premiums, while still providing quality insurance coverage for employees. Therefore, they are shifting more of the costs, including higher deductibles, coinsurance and co-payments, to employees and relying on other resources, such as supplemental carriers, for help.

Supplemental health products provide benefits to employees to help offset the larger financial exposures for out-of-pocket medical and non-medical expenses related to events such as hospital confinement, outpatient surgery, diagnostic tests resulting from a covered accident or covered sickness.

Tele-Medicine and Rx Discount

Unlimited 24/7 telemedicine program and discount RX program available to all employees at no additional cost.

The WellCard program o ers health and wellness products and services from brand-name vendors nationwide:

Pharmacy (retail and mail order)

Vision care and LASIK

Hearing

Dental

Medical network

MRI and imaging

Lab savings

24/7 doctor telephone consult

Medical bill help

Diabetes care and supplies

Vitamins

Daily living products

Cash rewards and entertainment benefits

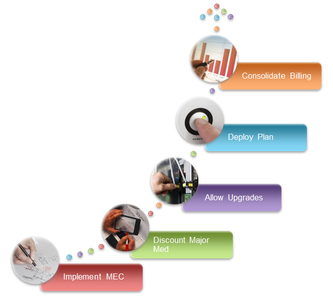

Enrollment Process

We can help. Our complete, end-to-end enrollment solutions are designed to lift the administrative burden from your shoulders, yet keep you in control at all times. With flexible enrollment options, we can handle as much, or as little, of the enrollment process as you need – at no direct cost to you.

Our enrollment partners handle the details, so you can focus on what’s most important – your business.

Legal Guarantee of Compliance

We supply our exclusive legal guarantee of compliance to employers who work with BCIA Compliance officers.